I bought a house, started a business, and went through a terribly dramatic breakup that drained all of my accounts before I was 24.

I had no money in my savings, $17,000 of credit card debt, and was barely scraping by with the income from my personal training business.

I realized quickly this was no way to live. I knew the self-proclaimed independence I craved didn’t mean much if I couldn’t manage my own money. I knew I didn’t want to rely on anyone to be able to live my rich life. This was all on me.

I started by printing out all of my bank statements for the year so far. It was June circa 2014, so I had 6 months of thousands of transactions to sift through and make sense of.

Enter: the 3 highlighter method

Step 1: Log in to your primary spending account(s)

Step 2: Open a blank spreadsheet

Step 3: Open last month’s statement(s)

Step 4: Type each line item into the spreadsheet.

On the left column, list out the merchant or where your money went. Next to that column, list the amount of money you paid.

Step 5: Pick 3 colors for each category:

-

Essentials

-

Discretionary

-

WTF

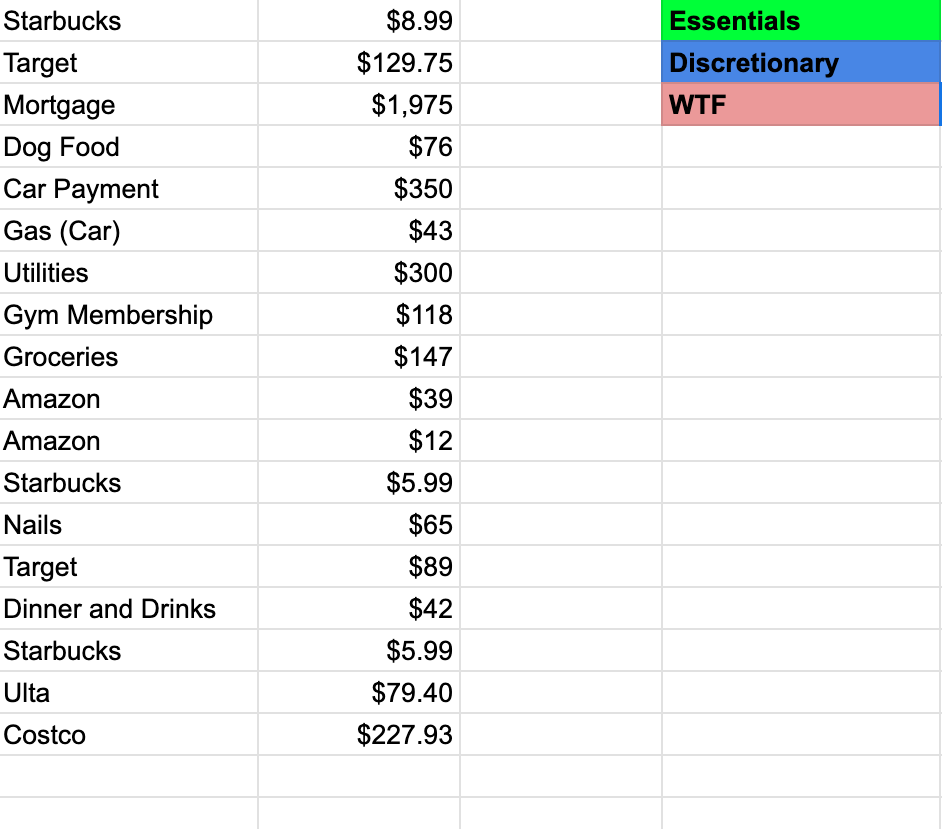

It will start to look something like this:

Tip: don’t color code as you go. Enter in all transactions first. If you spend across multiple accounts, open each statement and enter in the transactions. Once all of your transactions are entered, then begin color coding.

Pause here.

The big picture, color-coded version of behaviors and spending habits is one of the most powerful parts of this approach.

In the example above, without even doing any math, you can see that a majority of spending went to essentials but there are enough WTF moments that you can’t help but feel curious about the impacts.

Step 6: Add up your totals from each category.

The formula is =sum(_ + _ + _)

You literally have to:

- type in the equal sign, spell out “sum”

- open a parenthesis

- physically click on each transaction amount for the respective category

- You must type in + to select the next cell.

- When done selecting cells, you must close the parentheses.

It will look like this:

Bam. Now you have the value spent in each of the 3 categories.

In this example, I spent

- $2903 on essentials

- $431.90 on discretionary expenses

- $379.15 on WTF

The line between discretionary and WTF is really just a hierarchy of values. Today, you may decide that your gym membership is something that could go if it needed to, but you want to make sure there’s room in your spending for this as long as possible. In other words, you’d rather cut other things out in order to be able to afford your gym’s membership.

You can take this exercise even farther by parsing out each individual item from a merchant. For example, the Costco trip could have included necessities like toilet paper and laundry detergent. But it also could have included a hoodie, new books, 10 pounds of gummy bears, and a new font door wreath.

It’s up to you to be honest with yourself about where your money is going, how it feels, and where it falls on your hierarchy of values.

Putting it to use:

Let’s say you need to pay off $3,000 in credit card debt and want to add $10,000 to your emergency fund.

Using the 3-highlighter method, you can see exactly why you are or are not getting to your goals and paints the future of how much more progress you could be making.

Next month, you could take at least $379.15 and throw it towards your goals. If this were me, I’d split it in half and put $189.57 towards the CC balance and add $189.75 into my emergency fund.

Now I know when a friend asks me to go out for dinner and drinks, I might instead suggest a walk or coffee.

If I really wanted to make progress on my goals, I could consider cutting out nails and Starbucks for a bit and add an additional $42.98 into each account each month and still have money left over for some of my favorite discretionary expenses.

How you categorize each transaction can change. If last month getting my nails done felt like an empowered discretionary choice, but for the next 6 months I commit to not getting my nails done so I can add an extra $390 towards my goals, then I might begin categorizing it as a WTF to hold myself accountable.

So, give it a go.

Partner with yourself, become your own accountability buddy, and commit to getting to know yourself. The better you know yourself, the better you know your money and vice versa.

Happy highlighting!